In this Ethical Insights blog, guest blogger Martina Macpherson, Managing Partner of SI Partners Ltd., predicts that in 2016, investors will concentrate more on so called ‘social’ indicators, value and outcome, including human capital management, with a much stronger investor interest in:

New human rights-based assessments and reporting frameworks such as the UNGP Reporting Guidelines.

New legislation such as the Modern Slavery Act UK (2015) and the EU Directive for Disclosure of Non-Financial Information and Diversity (2017).

In 2014-15, investors were looking largely at non-financial risks centered on environmental issues such as climate change or more generally on sustainability and governance. In 2016, given a better understanding of the risks and defined metrics to assess these, we are expecting a shift towards social factors and their impact. This includes an area which is still underexplored - human capital management (HCM). So how can we define and align different stakeholder expectations and commitments in this area?

Defining and valuing human capital management (HCM)

Human capital is the knowledge, talents, skills, abilities, experience, intelligence, training, judgment, and wisdom possessed individually and collectively by individuals in society and in business. It’s the total capacity of people and represents a form of wealth which can be directed to accomplish the goals of a nation or a corporation.

Increasingly, the developed world has evolved into a service and information economy and as much as 80 per cent of a company’s worth is now tied to its people. Access to financial capital is no longer a source of competitive advantage, instead, competitiveness increasingly derives from know-how – people’s abilities, skills and competence.

Human capital is also a driver of economic and business growth - and is therefore vitally important for a country’s and an organization's success and increases through education, experience and opportunity. The OECD’s Human Capital Project researches methods to include HCM into national accounting and the UK Office for National Statistics (ONS) has measured the value of the UK’s human capital since 2004. There are also interesting studies, e.g. by PWC in 2014, that aim to ‘measure the economic value and impact’ of HCM practices at country level. The OECD’s Human Capital Project also researches methods for including human capital in national accounting and.

At company level, research suggests that firms with high levels of employee satisfaction generate superior long-term returns; however, such factors may take years before being positively reflected in a company’s share price. Some companies have begun to take steps to understand and attempted to measure the contribution of their human capital to their business (and to society) and to communicate these results publicly. However, many corporate HCM practices still show many shades of “grey” and precarious working conditions are on the rise, with women, minorities and migrant workers much more likely to fill these kinds of jobs.

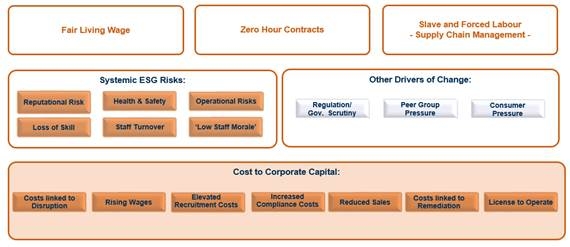

Campaigns led by the ILO, civil society groups and global unions have raised awareness of the impact of controversial human capital management practices on families, communities and even on countries. And efforts have been made to associate key HCM issues with hidden costs, reputational damage and a risk of increased regulation and government scrutiny as the following chart on how precarious working conditions can lead to systemic environmental, social and governance (ESG) risks and cost to capital shows.

How can investors identify and assess HCM data and metrics?

Despite an increasing acknowledgment of the importance of HCM, investors often find themselves unable to assess whether firms are able to deal with HCM risks given the absence of defined (reporting) metrics.

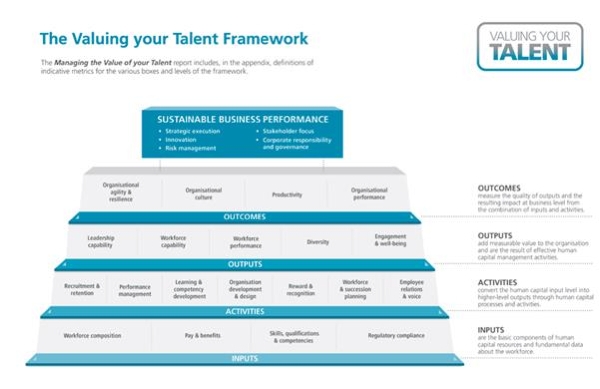

Key initiatives to quantify human capital and resource factors include the UK’s “Valuing Your Talent” (VYT) initiative. This utilises four key metrics that companies should consider publishing publically: “inputs, activities, outputs and outcomes” which concluded that “the total cost of salaries, annual recruitment costs, the amount spent on training and staff development, and employee satisfaction were important statistics that investors should be able to access”.

But it still remains challenging to establish transparent and consistent metrics, in particular when looking at HCM practices in the UK compared with emerging markets. Some investors have started to utilise a proxy such as employee safety. Prime examples where the safety record could have signalled future risk are BP - where imperfect safety procedures in its US operations led to accidents and eventually the Gulf of Mexico oil spill that cost the firm tens of billions - and most recently BHP Billiton, where shares hit a seven-year low after the Brazil dam disaster in November 2015.

How can expectations be better aligned to benefit workers, corporations, investors – and civil society?

Companies might want to minimise organisational and operational costs, but simply shifting risks towards the work force does not guarantee sustainability – in fact, it can make strong, sustainable corporate growth and steady progress impossible.

Some corporations such as Unilever are ahead of the curve and are building their business models around sound HCM practices and human rights risk management frameworks including the newly-established United Nations Guiding Principles Reporting Framework (2015).

It’s no surprise that 82 investors, representing US$4.8 trillion assets under management, are now supporting the UNGP Reporting Framework (as of July 2015) which is becoming an essential tool for corporates to know and show that they are managing risks to human rights effectively throughout their operations and value chain.

This is also true for investors who aim to review companies’ disclosure on their understanding and management of human rights risks, to incentivize improved disclosure on human rights issues, and to guide their engagement with companies.

Additionally, the new EU Directive is mandating disclosure of non-financial and diversity information by 2017 (Directive 2014/95/EU). And the Modern Slavery Act UK (2015) – which is the first legal act of its kind in Europe and one of the first in the world that addresses slavery and trafficking in the 21st century – will ensure that corporations become more diligent in assessing their exposure to human rights controversies along their supply chains or through their contractors and partners.

Yet reliable HCM metrics, human rights-led reporting tools and mandatory disclosure of non-financial information are just one side of the coin. Investor dialogue to better understand what is behind the figures and scores, and long-term engagement on key HCM issues, are also essential in order to put good HCM theory into even better corporate practice.

Find out more about ETI’s Ethical Insights Breakfast Briefings.